By: Fernando de Nuñez y Lugones – Executive Vice President and Chief Economist- ONE Sotheby's Int'l Realty

In a year as uncertain as 2020, we are keeping a close eye on the real estate market to advise our clients with timely, high-quality insights. Whether looking for a new permanent residence or an investment property, sellers and buyers have an array of options to choose from among the diverse markets along Florida’s East Coast.

In response, I want to present to you a summary report of current market trends from communities across Florida’s East Coast during the second quarter of 2020. As the market continues to shift, our global real estate advisors remain consistently connected to spot opportunities for immediate relocation, a lifestyle change or long-term investment for our clients.

Miami-Dade County: Healthy Average Sales Prices Bring Positive Opportunities for Sellers

Despite the Covid-19 pandemic, Miami-Dade County’s single-family home market has behaved particularly strong during the second quarter of 2020 in comparison to the condominium (condo) market. However, while the total number of single-family homes sold dropped by 5%, the number of condos sold dropped by a staggering 45% since the first quarter. Nevertheless, the single-family home average sale price in the $1 million plus bracket increased by 22%, while the $5 million plus bracket saw a jump in 43%, proving a stunning demand in the luxury market.

On the other hand, in the condo market, the average sale price increased more modestly at 3% and 4% for the respective brackets. We did notice that even though volume is down, the average price and average price per square-footage is up in all segments, including single-family homes and condos. This behavior is a result of the increasing supply of new development inventory hitting the market in the last two years.

Takeaway: It’s a great time for sellers to list single-family homes and for buyers to scoop up condos at attractive terms. This is especially true since the international market has shied-away due to the travel restrictions imposed as result of the Covid-19 pandemic.

Broward County: Generational Shifts Impact the Market and High-End Condos

In Broward County, the market has behaved similarly to Miami-Dade County, in terms of the decrease in number of transactions. Here, single-family homes saw a dampening effect with a 14% decrease in properties sold, while the $1 million plus and $5 million plus brackets experienced a 20% and 49% decline since the first quarter. These numbers show that the high-end market has suffered a considerable drop in the number of transactions.

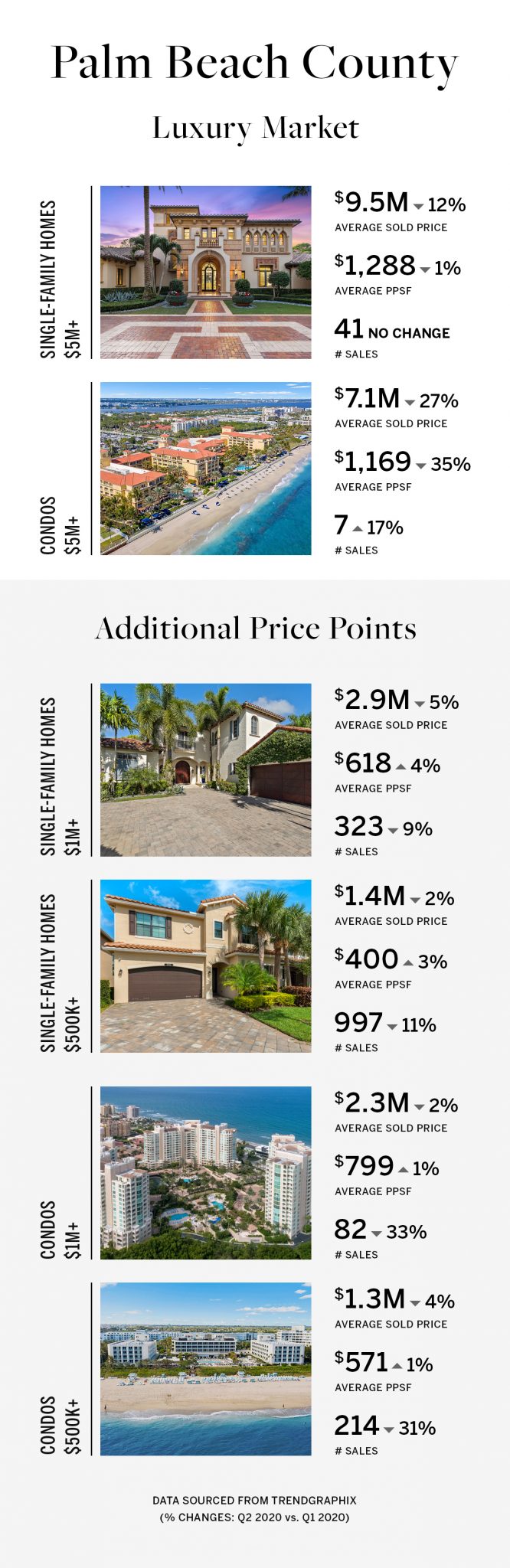

Palm Beach County: Unique Opening to Enter the Luxury Market

The single-family home market in Palm Beach County has been fairly unaffected during the Covid-19 pandemic. The number of transactions, average price and average price per square-footage have shown only small fluctuations, with a decrease in 12% to an increase in 4%. In contrast, the condo market witnessed a 31%, 33% and 35% slip in transactions in the $500,000 plus and $1 million plus brackets. There was also a 17% upsurge of demand in $5 million plus condos. So, despite this downward fall in activity within the $500,000 plus and $1 million plus brackets, price points have been largely unaffected. However, in the ultra-luxury market of $7 million plus homes, the average price dropped by 27% and the price per square-footage fell 35%. These steep declines make for a unique opening for buyers to enter the ultra-luxury market.

Martin County: Condo Market is on the Upswing

The Martin County region has shown strong trends in single-family homes and condos during the second quarter. Volume for single-family homes went up 7%, the average price increased 11% and the average price per square-footage jumped 13%. However, the luxury market of $1 million plus homes proved an even better performance in most key performance indicators (KPIs), with a 22% average price increase, 10% increase in average price per square-footage and 18% increase in number of transactions. Secondly, the luxury market was also on a strong upward trajectory with a steep jump of 400%. However, this increase is consistent with the number of transactions, modest 10% increase in price per square-footage and substantial decline of 37% in the average price.

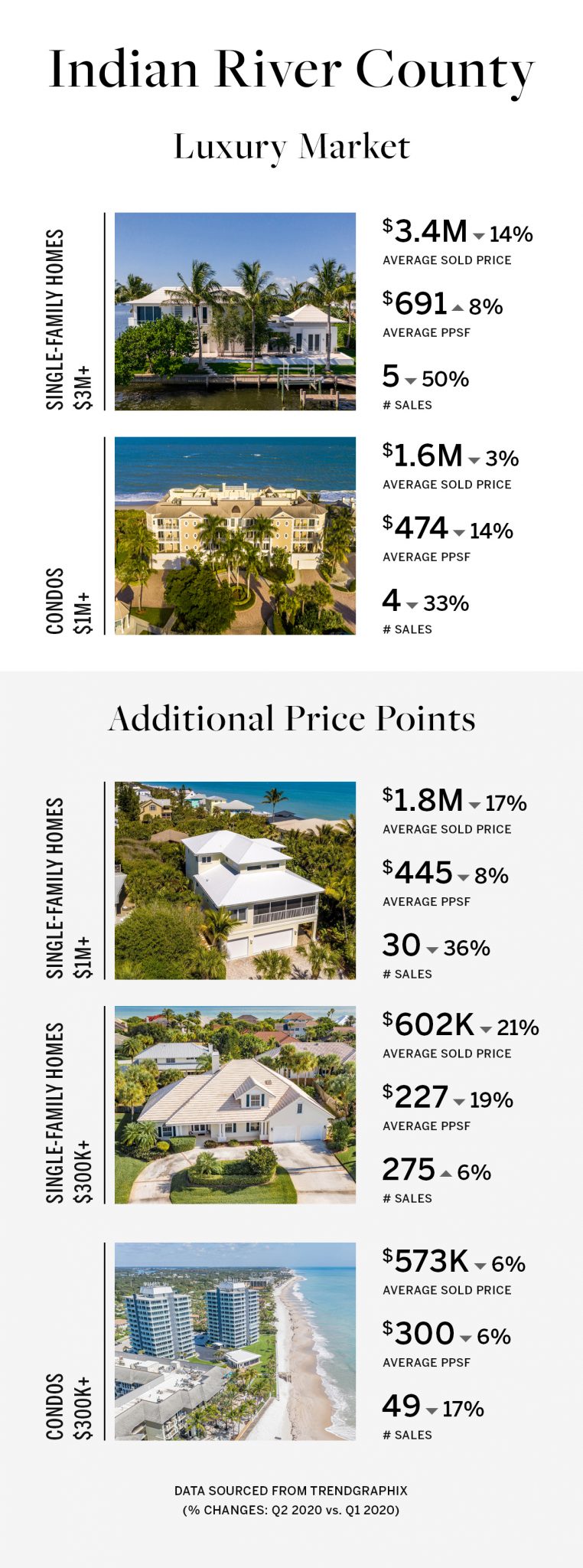

Indian River County: Strong Values Ideal for Smart Investors and Buyers Looking Ahead

Since the start of the Covid-19 pandemic, Martin County has seen more profound changes than its surrounding areas. For example, in the neighboring Indian River County, the single-family home market increased by 6% in the number of transactions, but the average price went down by 21% and the average price per square-footage declined by 19%. The luxury market in the $1 million plus bracket was also hit by a 36% decrease in the number of units sold, while the high-end luxury market in the $3 million plus bracket went down by 50%. In addition, average prices also declined 17% and 14%, respectively. These sharp drops

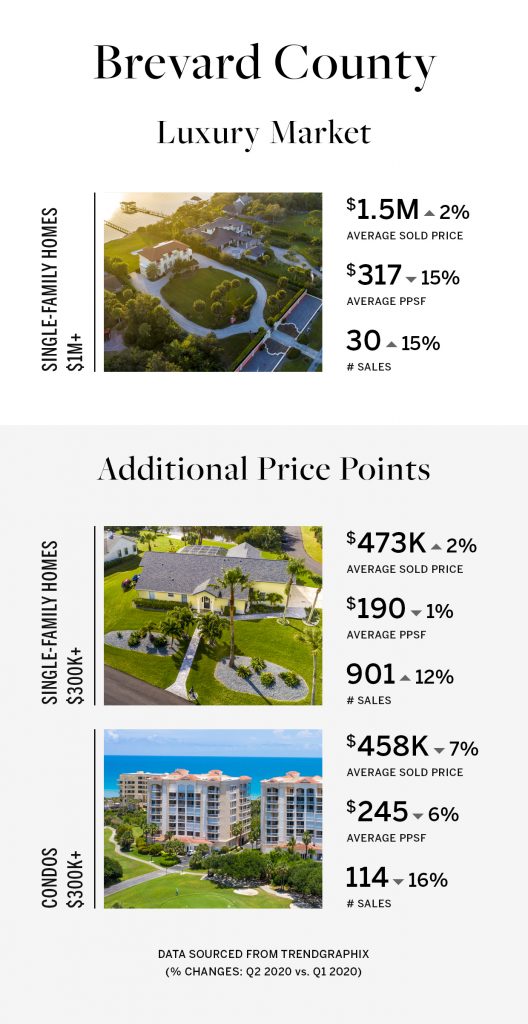

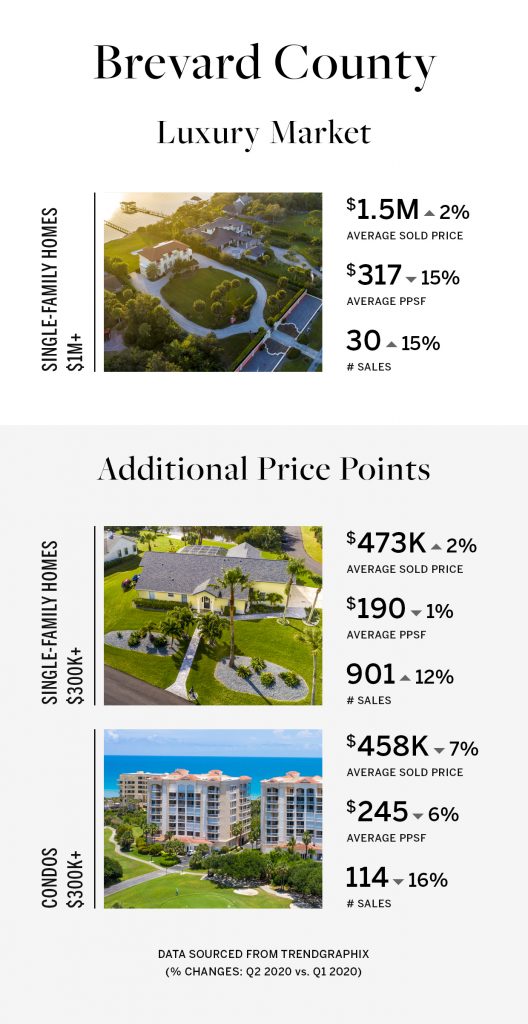

Brevard County: Strong Prospects for Long-Term Growth

Among all areas covered in this trend report, Brevard County boasts the least luxury-oriented market, showing signs of a price ceiling for single-family homes not exceeding $3 million nor condos exceeding $1 million. During the second quarter of 2020, the overall performance of the single-family home market wore fairly flat, with a dismissal increase in the average price of 2% ($473,330), whereas in condos there was slight decrease of 7% ($457,940). Furthermore, in the luxury single-family home market, the number of units sold was up by 15%, with a shy average price increase of 2%. These latest trends suggest an important question. Is there an opportunity to bring more luxury-oriented properties to Brevard County?

Takeaway: Due to the affordability of the market and natural beauty of the area, Brevard County shows a strong, long-term potential for growth. The increase in employment opportunities due to the air navigational industry, resulting in higher paying jobs, could potentially create an opportunity for an increase in the demand for luxury homes.

Positive Long-Term Outlook

In general terms, real estate along Florida’s East Coast has proven fairly resilient despite the difficulties derived from the Covid-19 pandemic during the second quarter of 2020. Two of the main consequences amid this time were the imposed travel restrictions that affected the inflow of out-of-state and international buyers and the limitations to show properties, especially in the condo market. However, the main driving forces that permitted the Southeast Florida market to still thrive were the changes in consumer preference, specifically those looking for less high-density housing alternatives and the benefits of a more outdoor-oriented lifestyle.

Nevertheless, long terms fundamentals remain strong, including but not limited to impressive immigration opportunities, companies relocating to Florida fueling employment growth and a favorable tax environment.